Quadratic and Cubic Terms in Linear Models.

In our weekly seminar, Robert Faff presented a paper with an OLS model with

the quadratic and cubic term effects. The dependent variable in this model

is the change in cash holdings (

The relevant part of the OLS model is

The results show that

You can see that the speed of adjustment depends on three coefficients and the

value of R.

First of all, I have to make a couple of assumptions because I don’t have the

full data. From the descriptive statistics, we know the meand (mopt) and

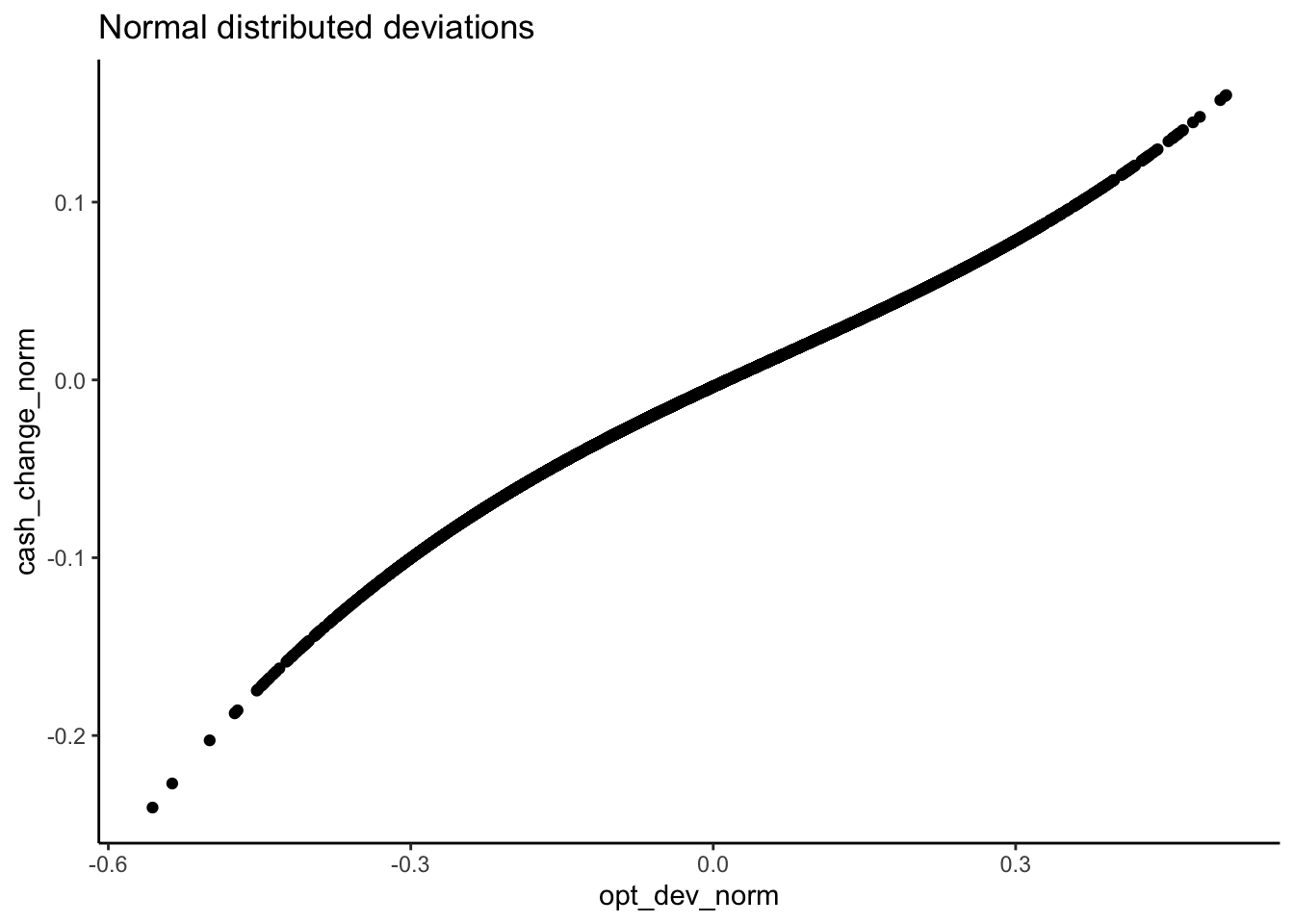

(sdopt) for opt_dev_norm) and a

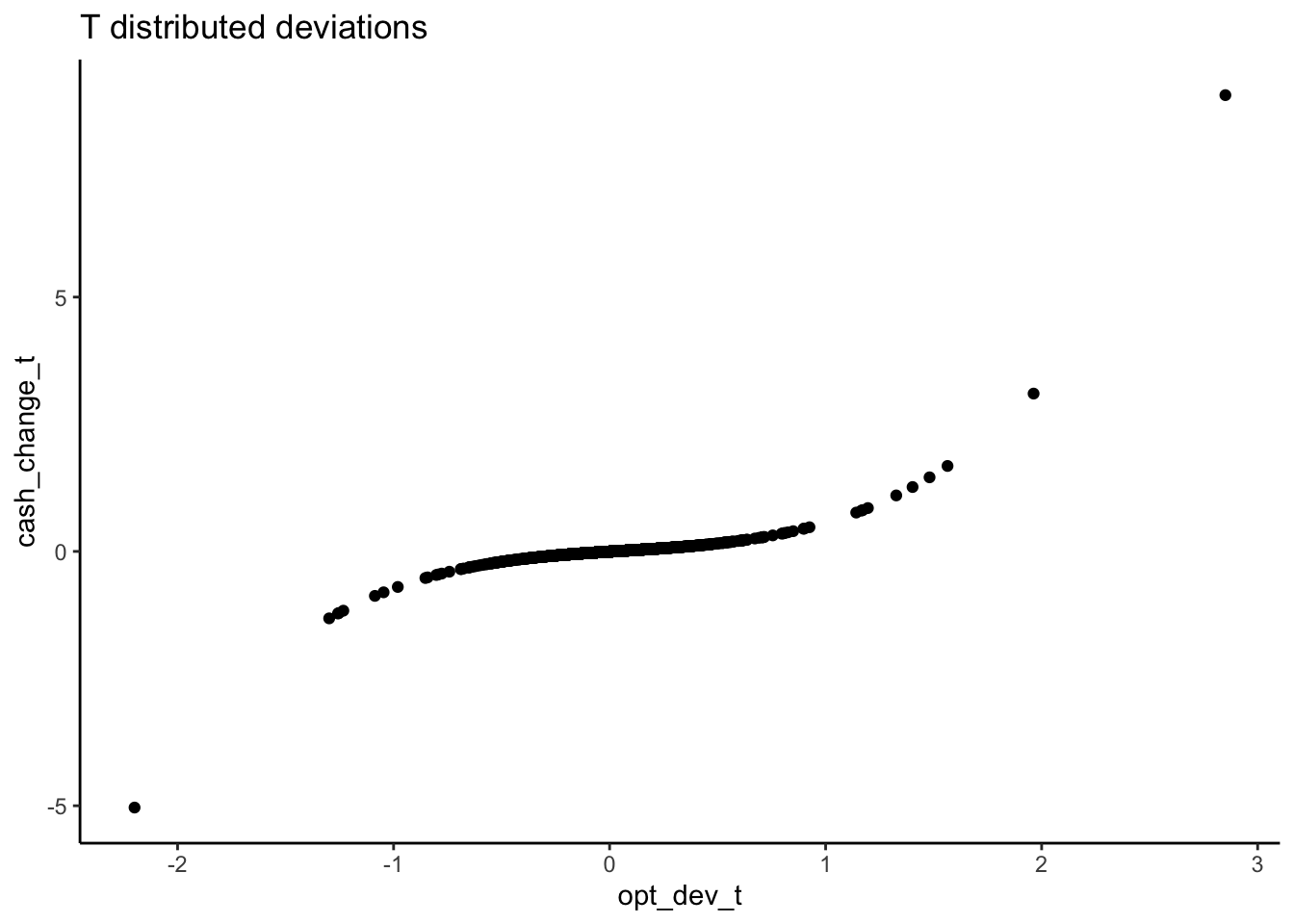

t-distribution with 3 degrees of freedom (opt_dev_t). The latter will give

us larger outliers. Than we just calculate the cash holding change based on

the ’s above and the OLS specification. Finally, you can plot the relation

between change in cash holding and the deviation from the optimal level.

What struck me was that the three regimes are much more clear with the t-distribution than with the normal distribution for the deviations. In other words, it looks like the extreme cases are doing a lot of work to identify the regimes.

require(ggplot2)## Loading required package: ggplot2mopt = -0.0026

sdopt = 0.1488

opt_dev_norm = rnorm(1e4, mopt, sdopt)

opt_dev_t = rt(1e4, df = 3) * sqrt(sdopt^2/3) + mopt

round(quantile(opt_dev_norm, probs = c(0.75, 0.5, 0.25)), 2)## 75% 50% 25%

## 0.1 0.0 -0.1round(quantile(opt_dev_t, probs = c(0.75, 0.5, 0.25)), 2)## 75% 50% 25%

## 0.06 0.00 -0.07cash_change_norm = -0.0038 + 0.2633 * opt_dev_norm - 0.0790 * opt_dev_norm ^ 2 +

0.3827 * opt_dev_norm ^ 3

normplot = qplot(x = opt_dev_norm, y = cash_change_norm) +

ggtitle("Normal distributed deviations") +

theme_classic()

cash_change_t = -0.0038 + 0.2633 * opt_dev_t - 0.0790 * opt_dev_t ^ 2 +

0.3827 * opt_dev_t ^ 3

tplot = qplot(x = opt_dev_t, y = cash_change_t) +

ggtitle("T distributed deviations") +

theme_classic()

print(normplot)

print(tplot)