Chapter 8 Control Variables

Oh, someone’s really smart

Oh, complete control, yeah that’s a laugh

The Clash - Complete Control

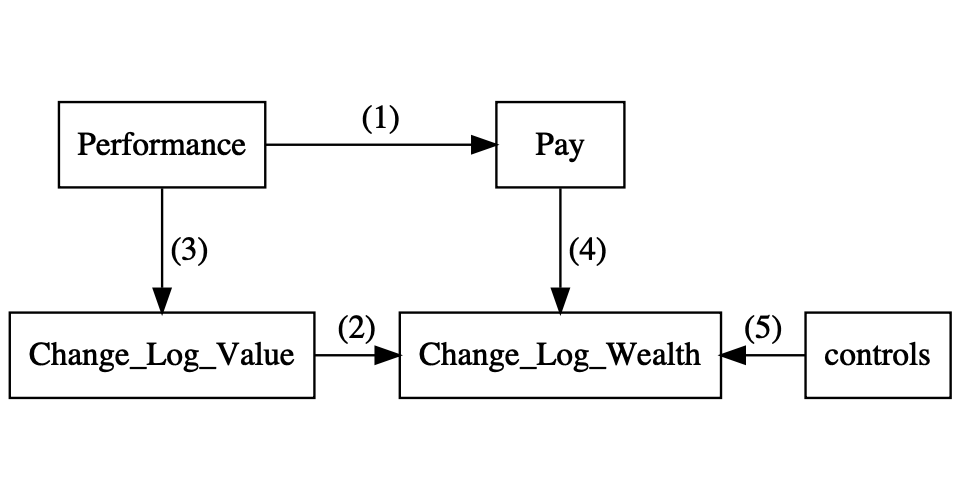

Let’s quickly revise the Libby boxes. In Chapter 5, we looked how we could better understand a mathematical theory. Simulations can help us to better understand the relation between firm size and compensation. This is link (1) in the Libby boxes. In Chapter 7, we focus on the links (3) and (4). The measures in the statistical analysis depend on the theoretical assumptions. In section 7.8, we focused on how we establish statistically a link between the two measures which is link (2) in the boxes.

Figure 8.1: Predictive Validity Framework or Libby Boxes for pay-performance sensitivity

Figure 8.1: Predictive Validity Framework or Libby Boxes for pay-performance sensitivity

8.1 R housecleaning.

We are going to run a lot of regressions in this chapter. I load

the stargazer package which helps to make tables of regressions.

suppressMessages(library(stargazer))

suppressMessages(library(tidyverse))

library(DiagrammeR)

tab_format <- getOption("knitr.table.format")We also need to reread the data and calculate some extra variables.

The most important feature is that we have a new dataset us_firm

with two important variables. The first one is ipo_employee or

whether the CEO was an employee when the company did their

initial public offering. The second one is ipo_ceo indicating

whether the CEO was already in their position when the company

launched their initial public offering. From section

7.4, we know that CEOs who are present early

in the life of the company might not have a compensation contract

that follows the efficient incentive contract.54 Not because they

are abusing their power necessarily, but because they are

intrinsically motivated to do well for the company and they are

motivated to stay in control of the company which is easier if

they have more shares than necessary from an incentive point of view.

us_comp <- readRDS("data/us-compensation.RDS") %>%

rename(total_comp = tdc1, shares = shrown_tot_pct)

us_value <- readRDS("data/us-value.RDS") %>%

rename(year = fyear, market_value = mkvalt)

us_firm <- readRDS("data/us-company.RDS")

combined <- left_join(us_comp, us_firm, by = "cusip") %>%

left_join(us_value, by = c("year", "gvkey")) %>%

mutate(ipo_ceo = I(becameceo < begdat),

ipo_employee = I(joined_co < begdat),

wealth = shares * market_value / 100) %>%

mutate(ipo_employee = if_else(is.na(ipo_employee), ipo_ceo,

ipo_employee)) %>%

mutate(ipo = ifelse(ipo_ceo, "ceo",

ifelse(ipo_employee, "employee", "none")))

combined_change <- group_by(combined, gvkey) %>%

arrange(year) %>%

mutate(

delta_total = log(total_comp) - log(lag(total_comp)),

delta_wealth = log(wealth) - log(lag(wealth)),

delta_value = log(market_value) - log(lag(market_value))) %>%

filter(!is.infinite(delta_total),

!is.infinite(delta_value),

!is.infinite(delta_wealth),

year > 2011)8.2 Directed Acyclical Graphs

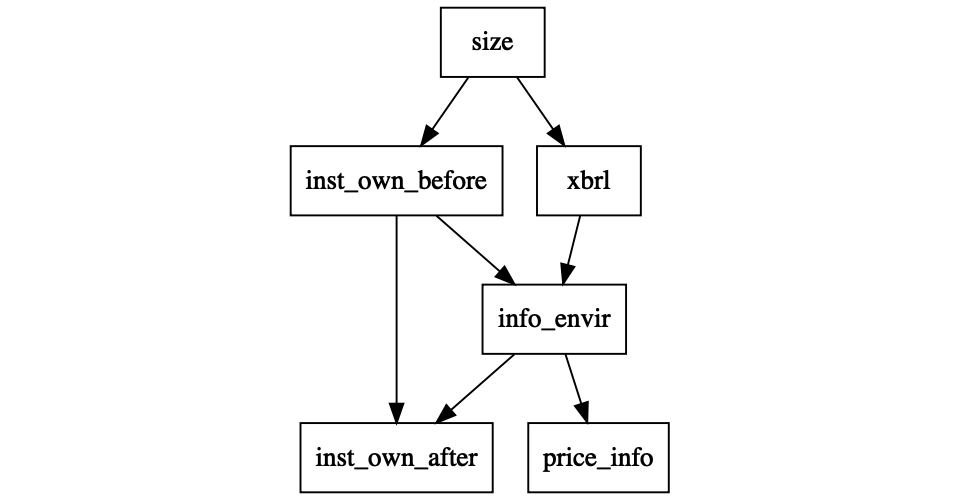

In this chapter, I will use Directed Acyclical Graphs (or DAGs) to visualise and understand the theory that applies to the empirical data. DAGs follow from the work of Pearl (2009a) and Pearl (2009b). I personnaly like the introductions in Cunningham (2018) and Rohrer (2018). Figure 8.2 shows an example of a DAG for a paper that was presented in our seminar. The setting is typical for a finance and accounting paper.

The key variable xbrl indicates whether a company has been

mandated to adopt the XBRL format to publish its financial

statements. XBRL is a mark-up language like XML that puts

structure on the financial statements and makes them more easily

machine readable which should improve the information environment

for investors. While the information environment can not be

directly measured, it is possible to measure the informativeness

of the stock prices in companies. XBRL adoption has been

staggered over three years, where larger firms were mandated to

adopt in the first year, the medium ones in the second year, and

lastly the smaller firms.

Figure 8.2: Example of a Directed Acyclical Graph

Figure 8.2: Example of a Directed Acyclical Graph

The paper is also interested in whether the adoption of xbrl

has an impact on institutional owenship in the company. The

difficulties with studying this relation are given by rest of the

DAG. The size of the company also affects institutional ownership

before XBRL adoption and studies have shown that institutional

ownership affects the information environment.

Figure 8.2 serves as an example of what a DAG for a single study can look like. For a typical study, the DAG can quickly become quite complex. One of the reasons is that a social science observational study always have to account for a large number of potential effects. The second reason is that DAGs do not allow for direct feedback loops55 That is what acyclical means and we have to account for the feedback between institutional ownership and information environment by adding a time modifier (before and after) to the institutional ownership variables.

8.3 Controlling for measurement error

8.3.1 Directed Acyclical Graph (or DAG)

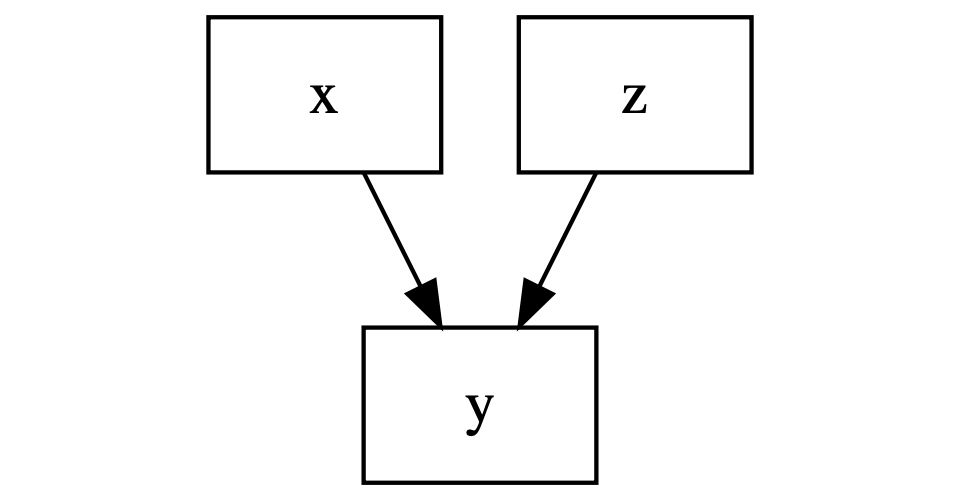

In the remainder of this chapter, we are interested in testing

the relation between x and y and we have to make a decision

whether we should control for z. The first reason to control

for a variable is because it affects the outcome of interest.

This is often the main reason given to control for a variable,

it affects the outcome.

Figure 8.3: Measurement error

Figure 8.3: Measurement error

8.3.2 Simulation

We can illustrate the problem with a simulation. We are

interested in the effect of x on y and there is another

factor z with a large effect on z. We print the regression

of y on x with and without z as a control variable with the

stargazer package (Hlavac 2018).

set.seed(12345)

obs = 500

x <- rnorm(n = obs); z <- rnorm(n = obs)

y <- rnorm(n = obs, mean = 1 * x + 20 * z, sd = 1)

d <- tibble(y = y, x = x, z = z)

yx <- lm(y ~ x, data = d)

yxz <- lm(y ~ x + z, data = d)

stargazer(yx, yxz, type = tab_format,

label = "measurement_error",

omit = c("Constant"), digits = 2,

intercept.bottom = FALSE,

star.cutoffs = c(0.05, 0.01, 0.001),

keep.stat = c("n", "rsq"))| Dependent variable: | ||

| y | ||

| (1) | (2) | |

| x | 0.97 | 1.07*** |

| (0.91) | (0.05) | |

| z | 19.99*** | |

| (0.04) | ||

| Observations | 500 | 500 |

| R2 | 0.002 | 1.00 |

| Note: | p<0.05; p<0.01; p<0.001 | |

The estimate of the effect of x regressions is close to the

true value, 1, but the standard error is much smaller when we

include z as a control variable. The reason to control for z

is to make sure that we have a precise estimate of the effect of

interest, however the estimate itself is not going to change when

z only has an effect on y.

8.3.3 Real Data

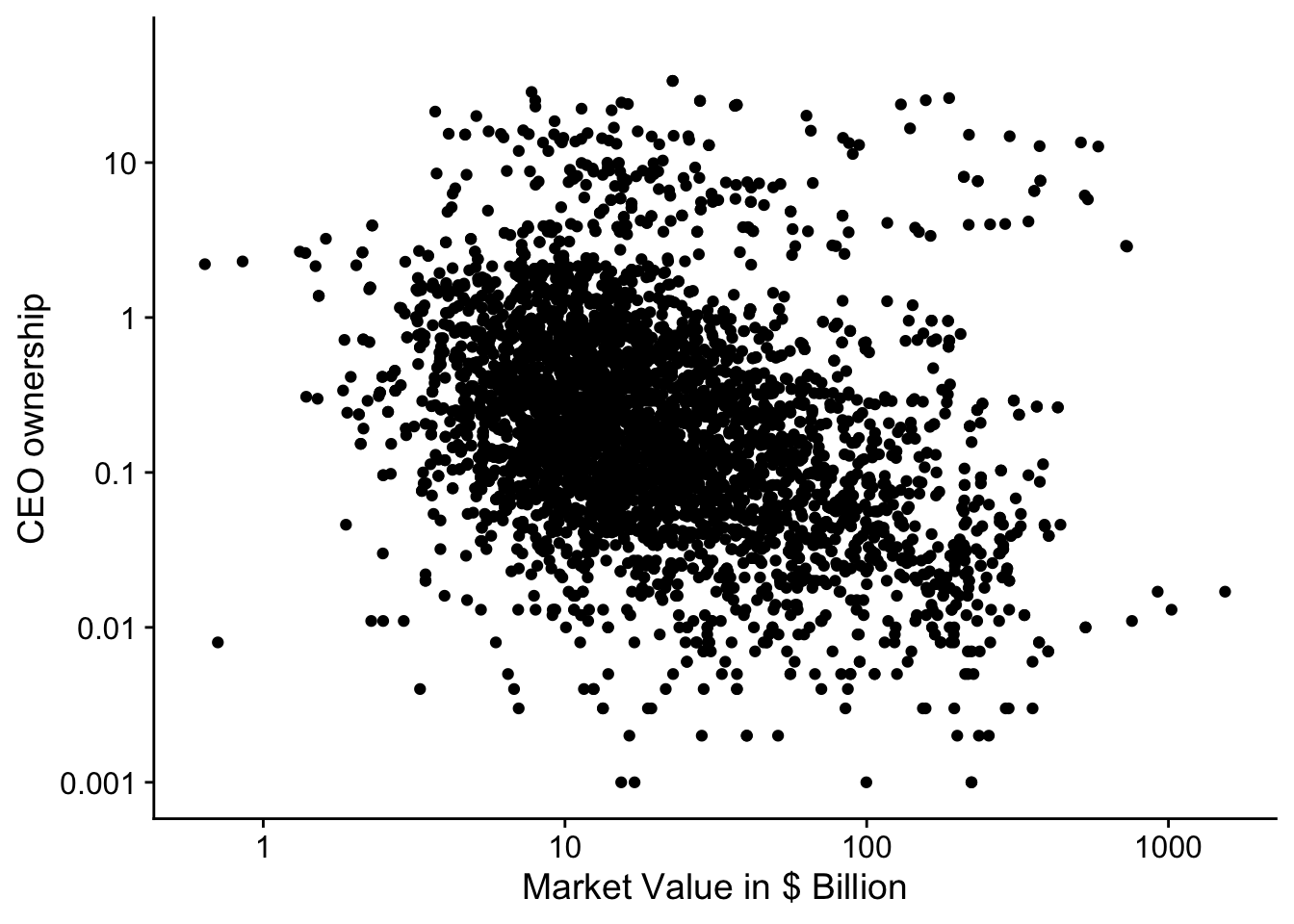

We can turn to the CEO data to illustrate the idea of controlling for other factors that might effect the variable of interest. We investigate the relationship between CEO ownership and market value of the company in Figure 8.4.

Figure 8.4: Relation between CEO ownership and market value for SP500 firms (2011-2018).

Figure 8.4: Relation between CEO ownership and market value for SP500 firms (2011-2018).

meas_data <- select(combined, market_value, shares, ipo) %>%

filter(complete.cases(.))

ownership <-

ggplot(data = meas_data,

aes(x = market_value/1000, y = shares + 0.001)) +

geom_point() +

scale_x_continuous(trans = "log",

breaks = scales::log_breaks(n = 5, base = 10),

labels = function(x) prettyNum(x, dig = 2)) +

scale_y_continuous(trans = "log",

breaks = scales::log_breaks(n = 5, base = 10),

labels = function(x) prettyNum(x, dig = 2),

limits = c(NA, 50)) +

labs(y = "CEO ownership", x = "Market Value in $ Billion")

print(ownership)## Warning: Removed 4 rows containing missing values (geom_point).We hypothesised back in Chapter 7 that

CEOs who are founders will have higher ownership for reasons that

have nothing to do with the optimal incentives. We cannot directly

measure whether CEOs are founders but we know wether they are

already CEO (ipo_ceo) or employee (ipo_employee) at the time

of the initial public offering of the company. We include those

two variables as indicator variables in the regression because it is

more likely that these CEOs are also the founders of the company56 I will

ignore the fact that we lose observations in calculating the new

variables. That is not necessarily a good idea..

form <- log(shares + 0.001) ~ log(market_value/1000)

base <- lm(form, data = combined)

form_error <- update(form, . ~ . + ipo_ceo + ipo_employee)

error <- lm(form_error, data = combined)

stargazer(base, error, type = tab_format,

label = "ownership",

digits = 2, intercept.bottom = FALSE,

star.cutoffs = c(0.05, 0.01, 0.001),

keep.stat = c("n", "rsq"))| Dependent variable: | ||

| log(shares + 0.001) | ||

| (1) | (2) | |

| Constant | -0.16*** | -0.46*** |

| (0.01) | (0.07) | |

| log(market_value/1000) | -0.47*** | -0.46*** |

| (0.01) | (0.02) | |

| ipo_ceo | 0.19 | |

| (0.11) | ||

| ipo_employee | 1.08*** | |

| (0.10) | ||

| Observations | 19,290 | 4,364 |

| R2 | 0.22 | 0.19 |

| Note: | p<0.05; p<0.01; p<0.001 | |

Unfortunately, controlling for ipo_ceo and ipo_employee does not

really improve the precision of our estimates for the effect of

market value on ownership. The standard error for the estimate stays

about the same (i.e.

8.3.4 Interpretation of Regression Outcome (or Economic Significance)

This is a bit of disgression of the main storay and you skip this section. Nevertheless, I would encourage you to go over the example as it gives a good example of how to interpret the numbers in a regression. Something, you will have to do for your thesis as well.

The regression we have estimated is

and based on the theory, we are mainly interested in the parameter

That conclusion is not correct. There are a number of ways you can

see this. When the CEO was already CEO at the time of the IPO,

they were also already an employee. That means that the ipo_ceo

variable is dependent on the ipo_employee variable. If

ipo_employee = 0 then ipo_ceo = 0 and if ipo_ceo = 1 then

ipo_employee = 1. You could also see this if you make a descriptive

table with the percentage of observations with each theoretical

combination of the ipo_ceo and ipo_employee variable.

combined %>% select(ipo_ceo, ipo_employee, year) %>%

group_by(year) %>%

summarise(

ipo_both = mean(ipo_ceo * ipo_employee, na.rm = T),

ipo_ceo_only = mean(ipo_ceo * (1 - ipo_employee),

na.rm = T),

ipo_empl_only = mean((1 - ipo_ceo) * ipo_employee,

na.rm = T),

ipo_none = mean((1 - ipo_ceo) * (1 - ipo_employee),

na.rm = T)

) %>% kableExtra::kable(digits = 2, booktabs = TRUE)| year | ipo_both | ipo_ceo_only | ipo_empl_only | ipo_none |

|---|---|---|---|---|

| 2011 | 0.17 | 0 | 0.07 | 0.76 |

| 2012 | 0.17 | 0 | 0.08 | 0.76 |

| 2013 | 0.17 | 0 | 0.07 | 0.76 |

| 2014 | 0.16 | 0 | 0.06 | 0.78 |

| 2015 | 0.14 | 0 | 0.05 | 0.80 |

| 2016 | 0.14 | 0 | 0.05 | 0.82 |

| 2017 | 0.12 | 0 | 0.04 | 0.83 |

| 2018 | 0.12 | 0 | 0.03 | 0.85 |

| 2019 | 0.11 | 0 | 0.03 | 0.86 |

| 2020 | 0.05 | 0 | 0.05 | 0.90 |

The table again shows that it is impossble for a CEO to have been the

CEO at the time of the IPO but not an employee57 ipo_ceo_only equals

0 in every year.. This example shows the importance of using

descriptive statistics to better understand the data. Even if you had

not realised that there is a relation between ipo_ceo and

ipo_employee, the table would have alerted you to it.

It also shows us that we cannot interpret the coefficients separately.

The right way to interpret the coefficients is to interpret them

together. However, there is a second problem with interpreting our

regression outcomes. We modelled log(shares + 0.001) and so the

effect are a bit harder to interpret. With some rearrangement of the

regression function, we can make the interpreation easier.

This means that the relation between ownership and whether CEO is a

(likely) founder is multiplicative. For a given firm size, the CEO

owns R.

beta2 <- error$coefficients["ipo_ceoTRUE"]

beta3 <- error$coefficients["ipo_employeeTRUE"]

exp(beta3)## ipo_employeeTRUE

## 2.949815exp(beta2 + beta3)## ipo_ceoTRUE

## 3.555428This means that the CEO who has already an employee at the time of IPO, has 2.9 times higher ownership and a CEO who was already CEO at the time of IPO has 3.6 times more shares than a CEO who was not in their company of similar size at the time of the IPO.

8.3.5 Better model of CEO founders

References

Page built: 2022-02-01 using R version 4.1.2 (2021-11-01)